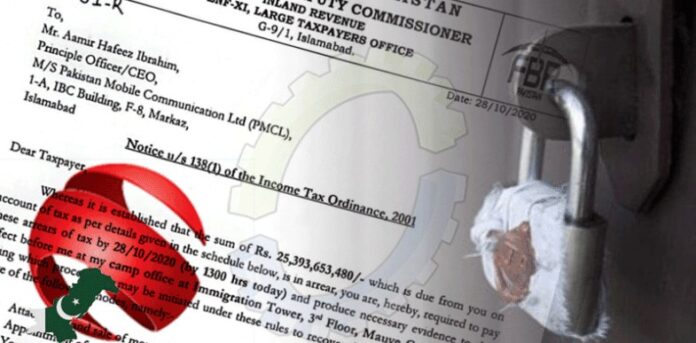

On Wednesday, the Federal Board of Revenue (FBR) sealed an office of Pakistan Mobile Communication Limited (PMCL) due to Rs25.3 billion in non-payment of income tax.

The Broad Taxpayers’ Office-Islamabad of the FBR has sealed the F-8 office of PMCL over non-payment of Rs22.03 billion income tax (Rs3.3 billion default surcharge) for the tax year 2018, according to documents available with this scribe.

The document states, “PMCL is an existing taxpayer falling in the jurisdiction of this office [LTU Islamabad]. An income tax amount of Rs25, 393,653,480 was outstanding against the said company, which has been refraining from clearing its liabilities deliberately, dishonestly and without any lawful excuse, thus causing huge loss to the national exchequer.”

It was also read that any non-compliance / defiance with this order is equivalent to an obstruction in the discharge of the income tax authority ‘s functions and is punishable under section 196 of the Income Tax Ordinance, 2001 by a fine or imprisonment for a period not exceeding one year or both.

The LTU had previously instructed the CEO of the PMCL to clear the amount payable by Wednesday and to provide the FBR’s office with the requisite evidence to that effect. The PMCL was also warned that, if the company fails to comply in this regard, the tax department could ‘attach and sell the movable or immovable properties of the company and arrest and detain the individual concerned for a period not exceeding six months,’ as provided for in sub-section (a), (ca) and (d) of section 48 of the Sales Tax Act, 1990.

The Jazz spokesman claimed that the organization “Is a law-abiding and responsible corporate citizen, with a substantial contribution over the past 25 years to the economy of Pakistan.”

“This afternoon, we got a note from FBR. Based on legal interpretations of the tax owed, Jazz has made tax submissions. We will review and take action in compliance with our legal obligations and will work with all the institutions concerned for an early resolution of this question,” he added.