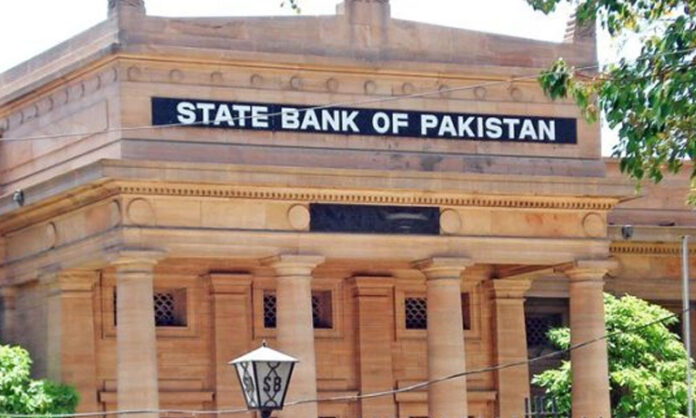

The State Bank of Pakistan (SBP) reduces markup rates to 5 per cent on investment refinancing schemes and implements further reforms aimed at facilitating the Covid-19 pandemic market.

Recognizing the adverse economic effects of the Covid-19 pandemic, State Bank of Pakistan (SBP) has repeatedly taken measures to safeguard businesses and households, and a policy rate reduction has been a key step since March 2020.

Despite improved outlook for inflation and aimed at helping the private sector, SBP has reduced the main policy rate to 7 percent by 625 basis points since 17 March 2020.

In order to expand the benefits of this policy rate reduction to users of its refinance schemes, SBP has now agreed to match end-user markup rates with two of its refinancing schemes to encourage investment in the country.

The end-user markup levels on the Temporary Economic Refinance Facility (TERF) have been curtailed by 2% and the Long Term Financing Facility (LTFF) markup rates for the non-textile sector by 1% with immediate effect.

By encouraging new investment and balancing, modernization and reconstruction (BMR) of existing programs, TERF SBP launched this facility to boost the economy.

SBP has reduced end-user mark-up rates from current 7 per cent to 5 per cent to further boost the opportunity under the TERF.

As per the SBP announcement, SBP will now provide refinancing to banks at 1 percent under the TERF system, with a maximum margin of 4 percent for banks and a markup limit of 5 percent for end-users.

State Bank has now raising its non-textile sector refinancing rate by 1 per cent and therefore the end-user rate for all sectors would be 5 per cent across the board. The above initiatives are intended to help promote long-term investment in both the domestic and export markets.