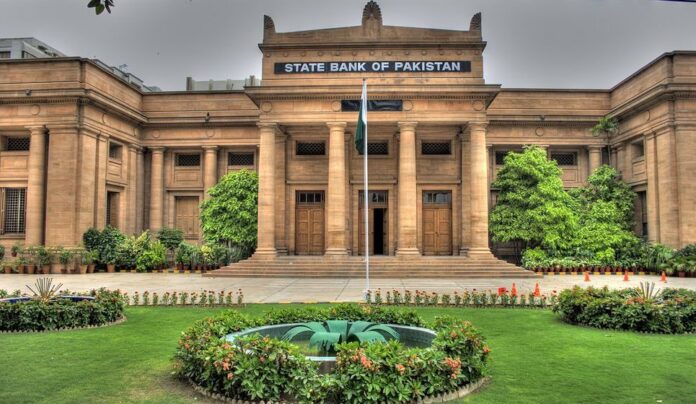

The State Bank of Pakistan (SBP) has submitted budget proposals for 2020-2021 which the Federal Revenue Board (FBR) is considering.

As per the media reports, The central bank has proposed to eliminate the withholding tax (WHT) on cash withdrawal from banks in the upcoming budget, which would curb the country ‘s rising cash-based transactions.

The central bank also demanded that the banking sector do away with Super Tax. It has introduced a few changes to the tax laws to rationalize various financial-sector tax provisions including withholding tax on cash withdrawals, corporate tax rate, super tax, and profit on debt.

The proposal suggested that the individuals and businesses reduce the use of banking channels to meet their daily financial needs, and prefer to keep cash in hand. The primary aim of the financial institutional withholding taxes on cash withdrawal was to discourage the cash economy and promote the economic recording.

It did have the opposite result, however, as it is actually encouraging cash-based transactions in the country and leading to an increase in circulating currency. The small depositors avoid keeping their money in the financial institutions because of this operational tax which leads to financial disintermediation in the country.

They are somehow growing the Currency in Circulation to Deposit Ratio which started to decline from 293 percent in June-15 and grew by just 41.1 percent on Jan 20. It is advised that the WHT should be removed on cash withdrawals as it will help improve the mobilization of deposits and the growth of financial inclusion.

SBP also suggested aligning the corporate tax rate for banks with that of other businesses by raising it from 35% to 29%. In a similar way, the super tax of 4 percent will also be removed in the coming budget in addition to the corporate tax limit. It has also proposed certain amendments to the Income Tax Ordinance 2001 that would allow the State Bank of Pakistan (SBP) and its subsidiaries to capture the full scope of tax exemptions.

SBP also recommended the provision of rebates/concessions to Micro Finance Banks (MFBs), Small and Medium Enterprises (SMEs), and Sharia-compliant enterprises to encourage financial inclusion and the growth of sharia-compliant enterprises.