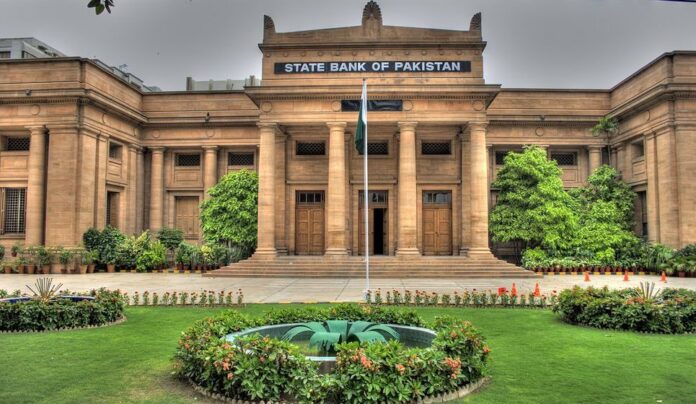

KARACHI: The State Bank of Pakistan (SBP) has decided to announce Monetary policy on November 19, 2021 instead of the scheduled announcement on November 26, 2021.

In a statement on Tuesday, the SBP said that the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has decided to bring forward its next meeting from the previously announced date of November 26, 2021. The MPC will now convene in SBP Karachi on Friday, November 19, 2021.

The meeting has been brought forward in light of recent unforeseen developments that have affected the outlook for inflation and the balance of payments, and to help reduce the uncertainty about monetary settings prevailing in the market.

The MPC will take stock of these developments and decide about monetary policy. SBP will issue the Monetary Policy Statement through a press release on the same day.

At its meeting on September 20, 2021, the Monetary Policy Committee (MPC) decided to raise the policy rate by 25 basis points to 7.25 percent.

Since its last meeting in July, the MPC noted that the pace of the economic recovery has exceeded expectations. This robust recovery in domestic demand, coupled with higher international commodity prices, is leading to a strong pick-up in imports and a rise in the current account deficit. While year-on-year inflation has declined since June, rising demand pressures together with higher imported inflation could begin to manifest in inflation readings later in the fiscal year.

With growing signs that the latest Covid wave in Pakistan remains contained, continued progress in vaccination, and overall deft management of the pandemic by the Government, the economic recovery now appears less vulnerable to pandemic-related uncertainty.

As a result, at this more mature stage of the recovery, a greater emphasis is needed on ensuring the appropriate policy mix to protect the longevity of growth, keep inflation expectations anchored, and slow the growth in the current account deficit.