The Securities and Exchange Commission of Pakistan (SECP) has approved a framework to enable resident and non-resident investors to open online accounts linked to the capital market. Being a key indicator of the Commission’s digital transformation agenda, the new framework will allow investors to open accounts with a broker without the hassle of submitting documents physically.

A Summarized Guide To Open Online Accounts With SECP

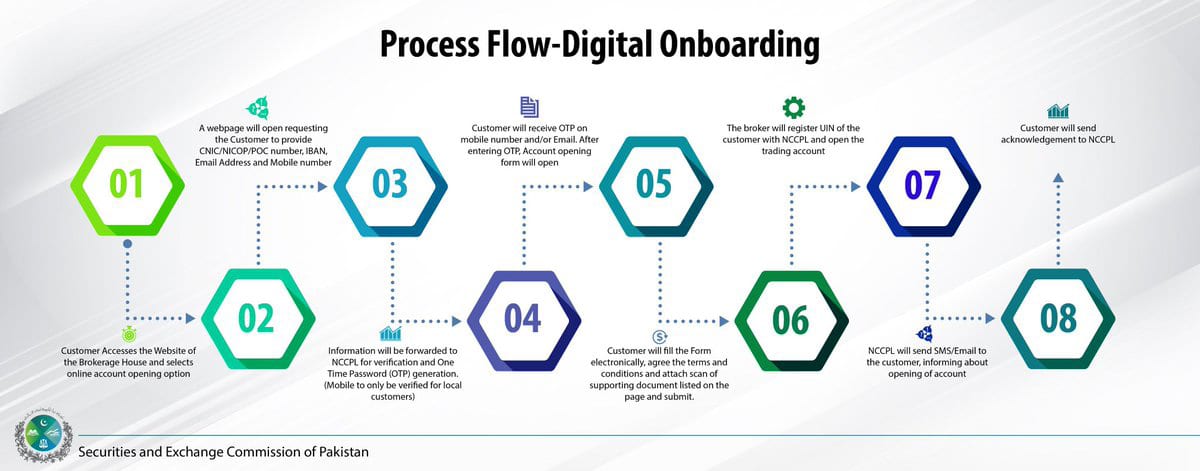

Here’s how to create an online account to invest in stocks, according to the Commission’s updated digital mandate:

- The customer accesses the website of the brokerage account and selects the online account opening option.

- A webpage will open, requesting the customer to provide CNIC/NICOP/POC number, IBAN, Email Address, and Mobile number.

- The information will be forwarded to the NCCPL for verification, and One Time Password (OTP) will be generated.

- The customer will receive OTP on the mobile number and/or email. After entering the OTP, the account opening form will open.

- The customer will fill the form electronically, agree to the terms and conditions, and attach scanned copies of supporting documents listed on the page and submit.

- The broker will register the UIN of the customer with NCCPL, and open the trading account.

- NCCPL will send an SMS or Email to the customer, informing about the opening of the account.

- The customer will send an acknowledgment to the NCCPL.

Here is a visual backdrop of the digital onboarding process, as stated and governed by the SECP:

Choosing the right brokerage account can be difficult, but with the Commission’s new digital account opening process, things get a lot easier. The new framework will revolutionize Pakistan’s capital markets and contribute significantly towards economic growth in the country by channeling investments and savings through relevant investment pipelines.