The Federal Revenue Board (FBR) has drawn up tax plans for the 2020-21 budget, concentrating primarily on “simplification of regulations and the removal of tax anomalies.”

There are some rumors that the government is expected to declare a ‘tax-free budget,’ said Dawn, adding a final decision would be made after consultation with the International Monetary Fund (IMF) following Eidul Fitr.

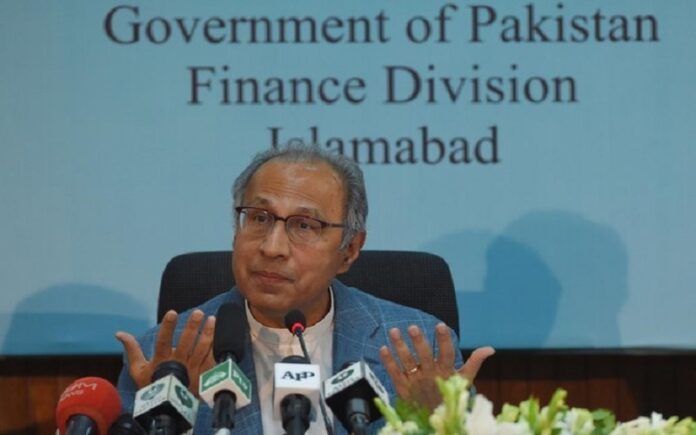

According to Abdul Hafeez Sheikh, next year’s budget would be termed as “corona budget.”

It will depend on the IMF whether it considers Pakistan’s proposal to lower the TY21 tax goal. The Fund proposed a tax target of Rs5.1 trillion for the next year, which is 30pc higher than the expected estimate for the FY20.

The IMF has lowered the FBR tax target to Rs3.9tr from Rs4.8tr for the current year to reduce the effect of Covid-19 on business. Nevertheless, the achievement of this goal also relies on the revival of activities before and after Eid and the whole of June.

Sources informed Pak Revenue that the Fund officials meeting with the Pakistani economic team would decide the course of the next budget, whether it will be tax-free or have some kind of tax to reach the next year’s goal.

“FBR has already completed its homework on next year’s budget proposals and is currently working on finding problems that should be eliminated,” the official said.

“We are also working on simplification of tax laws to facilitate taxpayers,” he added.

However, at the same time, the FBR also includes all stakeholders in finding resolution tax-related issues. “In the next budget, we’ll also suggest tax incentives for certain sectors to help them revive their companies,” they added.

Some of the stakeholder proposals on the table are the restoration of zero-rating for the five export-oriented industries, allowing lower sales tax rates on textile domestic products, clothes, waivers of CNIC conditions for traders, and a reduction of the sales tax rate from 17% to 5%.

Tax officials private to budget-making said the FBR would seek to stop new tax schemes being implemented but will protect the continuity of those already in place. “It’ll be better, for now, to maintain our current tax policies and see how it’s going throughout the year,” the officials remarked.

Currently, the emphasis is on the ease of doing business and supporting taxpayers with the assistance of information technology. The FBR will be endorsing any new taxation plans as the economy revives, they added.

A senior tax official, however, said the FBR can’t do away with the maximum tax initiatives that exist. “We need money to operate the government machinery,” he said, adding that steps such as printing notes would contribute to the country’s inflationary pressure.

The FBR has already worked out the effect on the country’s revenue generation from the continuing shutdown and closure of companies. At the behest of Prime Minister Imran Khan, the IMF approved the Construction sector incentive package for job development.

In the first quarter (July-September) of the next fiscal year, the FBR expects a revenue loss of Rs450 billion, in case the partial lockdown continues. It further projects that the tax body will see another shortfall in revenue realization to the tune of Rs350bn should the partial lockdown continue.

The FBR forecasts also show that imports will stay on the lower side in the first half-year and so is the case of exports until orders revive. The domestic economy will recover to some degree though revenue collection from the services sector will be far lower from last year’s point.