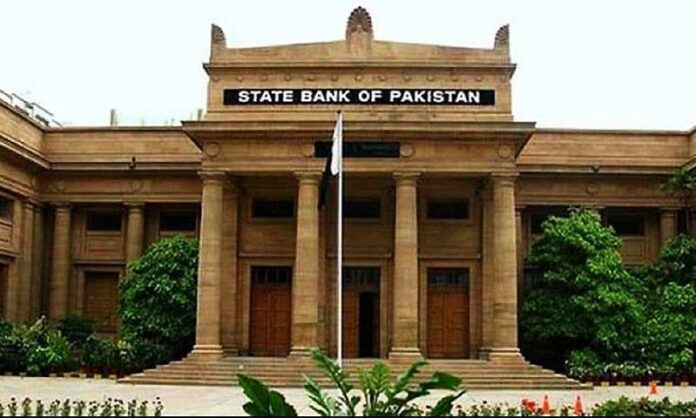

Bank deposits increased by 12 per cent year-on-year, while their total investments, particularly in government securities increased by 40% during the fiscal year, the State Bank of Pakistan announced on Tuesday.

The total deposits of banks increased by 12.2pc to Rs16.229 trillion by June end, compared to Rs14.458tr in same time last, an increase of 1.771tr. Overall money supply of the country increased by almost 16% in FY20, compared to 11.3% last year. Yet lending by the private sector remained deeply depressed during the year as advances in the same period rose to a meagre 1.2%.

As per the State Bank reports, it crossed the Rs11tr level, the investment in government papers touched record high.

The T-bills had received Rs6.052tr while Rs5.27tr was invested in PIBs until June 30. The government papers were highly lucrative before March as the returns were over 12.5pc but the SBP started a series of policy rate cuts with the introduction of Covid-19 – cutting it by a cumulative 625 basis points to 7pc.

Overall planned banks’ investment jumped by 40pc during a year as it reached Rs10.681tr till June, rising by Rs3.057tr over Rs7.624tr in the same period last year. Much of this capital went to the securities of government.

The domestic trades and industry hadn’t borrowed much from banks before the pandemic, mostly because of the high interest rate of 13pc, and now it’s taken on another blow.