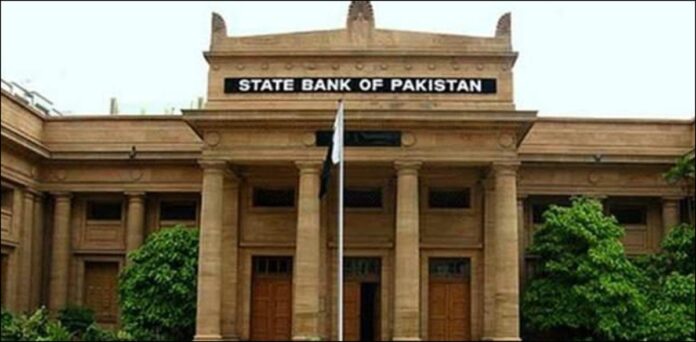

The State Bank of Pakistan (SBP) on Wednesday ordered banks to suspend disbursement of dividends for quarters in March and June 2020.

Leading bankers have reported to Business Recorder that for the first two quarters of this year, SBP has asked financial institutions to suspend the dividend disbursement.

As per the official guideline issued by the SBP Department of Banking Policy and Regulations to mitigate the impacts of the COVID-19 pandemic, On 26 March 2020, State Bank of Pakistan announced a series of regulatory relief measures through various circulars.

The SBP circular said, “Banks/DFIs are being allowed to extend financing to such vendors/distributors against corporate guarantee(s) issued on their behalf to facilitate vendors/distributors who are suppliers/distributors of large corporates.”

Among other issues, these steps include reducing the Capital Conservation Buffer (CCB) and easing the conditions for the rescheduling/restructuring of loans.

These regulatory reliefs are aimed at improving banks’ lending ability, preventing any adverse impacts on their asset quality, and maintaining a continuous flow of credit to support economic activity in these pressing times.

In order to preserve capital and further boost the lending and loss absorption ability, banks / DFIs / MFBs are advised to suspend income distribution by announcing dividends in any way (cash or stock) for the quarter ending March 31, 2020, and the half-year ending June 30, 2020. These guidelines do not apply to reported dividends for the year ended December 2019.

Banks have been told to put this order before the banks / DF1s / MFBs board of directors. However, if the Board of Directors finds it appropriate to declare the dividend in the wake of the special circumstances of the company, it may approach SBP with sound justifications for merit consideration of the proposal.

Businesses have also been granted the freedom to make use of loans under the SBPs refinancing scheme for any bank’s salaries, and they will not be limited to making use of bank loans that handle their payroll.

Furthermore, in cases where customers have applied for funding under the scheme and before the loan applications are approved, customers disburse salaries from their sources for April 2020, PFIs may refund these salaries/wages to customers after their loan applications have been authorized.